So, how the heck do freelance income taxes actually work in Canada?

Freelancing is something a lot of us are doing nowadays, whether it’s a full-time thing or something you do part-time.

However, no one really talks about the whole finance side of it!

We all know people who sell homemade products on Etsy, write for popular online magazines, or even do MLM marketing (although you might not agree with it, it’s still a business).

It’s kind of confusing figuring out all this tax stuff, especially if no one else you know is self-employed as well.

Even if you have other self-employed friends, they might not really know what they’re doing, either!

What can you count as a business expense?

How do you even file freelance income taxes in Canada?

Tax season ain’t fun for anyone, and it’s something you should be preparing for year-round.

I’ll be breaking down a few things you should know about freelance taxes in Canada.

Here’s what you need to know about filing freelance income taxes in Canada, whether you’re self-employed or a side hustler!

Be sure to also follow me on Instagram and TikTok – I share a lot more content on those platforms that don’t make it to the blog!

Disclaimer: I’m not an accountant or an expert in finance. I’m simply sharing information from my own personal experience and research. It’s up to you to file your taxes correctly, and hopefully these tips will be helpful to you. Please consult an accountant for professional advice!

What is a freelancer in Canada?

A freelancer (or self-employed worker) is someone who does contracted work on behalf of other companies.

This could be a journalist who writes for various Toronto news outlets, or a photographer who shoots weddings across Ontario.

Freelancers essentially work for themselves, and they can do so even while working as employees at other companies.

This depends on the industry of course, as some social media agencies don’t allow you to do freelance social media management.

Some companies consider it a conflict of interest, especially because you can always take their clients and offer them your freelance services at a lower fee.

Here are some examples of freelance jobs people do:

- Writer or blogger

- Photographer

- Virtual assistant

- Copywriter

- Graphic designer

- Illustrator

- Web developer

- Event planner

Freelancing comes in many different forms, and while I’ll be talking about freelancing as a whole, I’ll also be focusing on more specific jobs like blogging and writing.

I’ve worked freelance as a writer, photographer, and social media manager for both Canadian and American companies.

I started blogging full-time in mid-2018, which is also when I started taking the business side of things more seriously.

Do freelancers need a business license in Canada?

Wondering if freelancers need a business license to operate in Canada?

Anybody can be a freelancer and you don’t have to register a business name or incorporate if you don’t wish to do so.

You can simply operate as a freelancer under your own name.

If you do a lot of freelance work, it might be useful to incorporate your business to protect you legally, as a corporation operates as a separate, individual entity.

There are also some tax benefits if you incorporate your freelance business.

How do I incorporate my business in Canada?

If you’re looking to incorporate your business, you have to do so within your province.

Lawyers typically charge between $1,000 to $3,000 to incorporate your business.

Online incorporation services like Ownr charge lower fees than what lawyers charge, at around $500 to $700.

You can also incorporate yourself online for a lot less than what lawyers or incorporation services charge, but you’ll have to do the nitty gritty work yourself.

Even if you do incorporate with a lawyer, you’ll have to register for a GST/HST number and payroll account on your own (if applicable).

I’m saying this because my lawyer didn’t inform me, and I had to scramble to set up my accounts during tax season!

How to invoice as a freelancer in Canada

The thing about being a freelancer is that you have to put together your own invoices to send to clients.

However, Wave does offer free invoicing services to make it a bit easier, and they allow your clients to use credit cards for payments.

If you’re looking to do it manually, you can find plenty of great and free self-employed invoice templates on Canva.

You can also sign up for my mailing list below to get a free printable invoice template for self-employed and freelance Canadians!

Here’s what you need to include on your invoice as a freelancer:

- Your name or business name

- Your address or business address

- Email address

- The invoice number

- Descriptions of services provided

- Fees for each service

- Taxes (if applicable)

- The total amount

If you want, you can also add a clause at the end stating any late fees that might incur if invoices are paid late.

Things to know about freelance taxes in Canada

Now, onto things you need to know when filing your freelance taxes in Canada!

Some of these are pretty obvious, while some are things you might not have realized.

Anyway, hopefully you find these things helpful for when you file your taxes!

1. Keep track of your freelance income and expenses for the Canada Revenue Agency

You’re required by law to report all freelance income to the Canada Revenue Agency (CRA), even if it’s as small as $50.

Any income you ever make needs to be reported to the CRA.

Record your income and expenses

You can use a program like QuickBooks or Simply Accounting to manage your accounting and invoices.

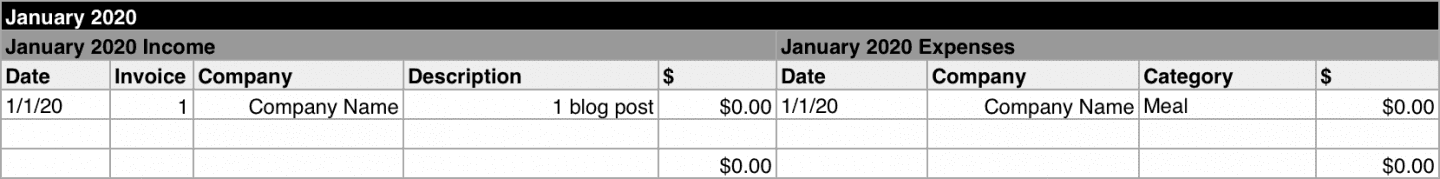

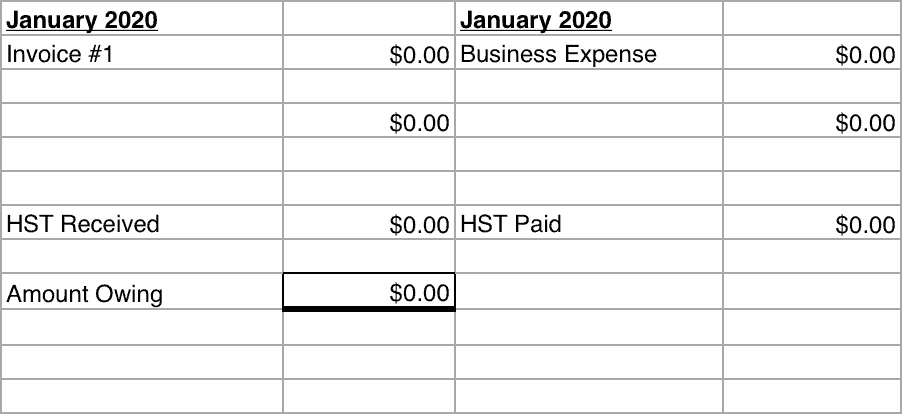

I personally use my own yearly spreadsheet template where I break my income and expenses down by each month.

I’m a spreadsheet person, and I just like to have everything in detail in one place!

I’ll talk about how I put together my spreadsheet in more in detail below.

Income

For the income column on my spreadsheet, I mark down the following:

- Date

- Invoice

- Number

- Company

- Dollar amount

You don’t have to write a description, but I often have many different invoices for the same clients and it makes it easier for me to track which ones have been paid.

Even if you haven’t been paid yet (and might never be lol #freelancelife), you still have to record it and report it according to the date you invoiced the client.

If one of your invoices never gets paid, you can claim it in the future as a loss.

Expenses

For the expense column, I mark down the following:

- Date

- Company

- Category (as labelled by the CRA)

- Dollar amount

Things you can claim include meals (partially), rideshare rides, photoshoot props, and website fees, as long as they’re beneficial and profitable to your business.

Hold onto all of your receipts

Keep all of your physical and digital receipts and store them away somewhere safe.

You have to keep all your records for at least 6 years, a time in which the CRA can audit your business.

It helps to also write down on the back of your receipts what the purpose of the expense was and who you were with.

This way, if you get audited for something 5 years later, you won’t have to think back on what the receipt was for!

I’d also recommend organizing your receipts at the end of each month so you don’t have to scramble when tax season rolls around.

Declare your income to the CRA

At the end of each year, you need to to declare your income and expenses to the CRA via income tax forms.

Your net income is what you get taxed on at the end of the year, which is your income minus expenses.

So, if your income for the year is $30,000 and your expenses are $5,000, your net income is $25,000.

2. Income tax forms are different for those who are non-incorporated vs. incorporated

So, how exactly do you report freelance income in Canada?

The forms you need to fill out to file your income taxes differ depending on whether your business is non-incorporated or incorporated.

If you’re reporting self-employed income and you’re not incorporated, you need to fill out the T2125 form.

If you’ve incorporated your freelance business, you have to file separate personal and business taxes through a T1 and T2.

3. Set aside at least 30% of your income for taxes

If you’re working as a freelancer, you’re likely not paying any taxes when you receive your income.

When you get a paycheque from an employer, taxes are already deducted on the paycheque.

This means you need to hold onto funds to pay your freelance taxes in Canada when the time comes.

Always make sure to set aside at least 30% (probably more) of your income for taxes, HST, as well as Canada Pension Plan (CPP) contributions.

Federal tax rates are between 15% to 33% depending on your net income, and provincial tax rates differ depending on your province or territory.

GST/HST

The amount of GST/HST you have to remit to the CRA depends on the amount you’ve collected from your Canadian clients.

If your freelance business is making under $30,000 yearly, you don’t have to worry about GST/HST, and I’ll talk about that more in a bit.

Canada Pension Plan

Working people in Canada have to contribute to CPP, and the amount you contribute depends on your net income.

The max an employee can contribute is $3,754.45 yearly, which their employer has to match.

If you work for yourself, you have to pay both the employee and employer’s portions, which is a max of $7,508.90 yearly.

4. You only have to charge GST/HST if you make over $30,000 in one year

The whole GST/HST business can be a little bit confusing, but let me break it down for you.

Once you surpass $30,000 gross income within a calendar year, you are no longer classified as a “small supplier”.

You are then responsible for voluntarily registering for an HST number and collecting HST for the CRA.

You can get hit with penalties later if you don’t!

Another important thing to note is that GST/HST is filed separately from income tax returns.

You can find more info on the whole GST/HST shebang on the CRA website.

How do I manage the GST/HST I collect from my clients?

One major thing to note about GST/HST is that it is not your money to spend.

Many businesses get freaked out when it comes around to paying it because they forget they’re collecting and remitting it for the CRA, and it’s not part of their income.

If you invoice $100 plus HST in Ontario and receive $113 from your client, $100 of it is yours and $13 is for the CRA.

If you’re afraid of touching your HST money, create a separate chequing or savings account and put all of your HST collections in there for year end.

Do GST/HST charges depend on the province or territory?

The amount of GST/HST you charge depends on the province of the company you’re invoicing.

For example, if you’re invoicing a company that’s based in Ontario, you must charge them an HST of 13%.

You may also have to charge QST and PST, and you can find out more info about both on the CRA website.

Here’s a full list of the HST rates per province and territory:

- Yukon – 5% GST

- Northwest Territories – 5% GST

- Nunavut – 5% GST

- British Columbia – 5% GST

- Alberta – 5% GST

- Saskatchewan – 5% GST

- Manitoba – 5% GST

- Ontario – 13% HST

- Quebec – 5% GST

- Newfoundland and Labrador – 15% HST

- New Brunswick – 15% HST

- Prince Edward Island – 15% HST

- Nova Scotia – 15% HST

For companies outside of Canada, you don’t charge them any GST/HST as they are labelled as zero-rated.

When putting your invoice together for international clients, just put the tax rate as 0%.

Can I collect GST/HST before the $30,000 threshold?

So here’s the answer to the question a lot of Canadian freelancers have: do you charge tax on freelance work?

You do not need to charge any taxes if you’re making under $30,000 as a freelance business in Canada.

If you do a $500 job, you simply invoice your client for $500.

However, you can register for and collect GST/HST before the $30,000 threshold if you want.

Why would you want to collect GST/HST before you have to?

First off, it makes your business look more credible and professional in the eyes of your clients.

Another benefit is that you can claim HST on your business expenses, which I’ll explain more about next.

5. You can claim HST on business expenses

If you’re spending a fair amount on your business expenses, you’re going to want to claim the HST on them.

As I said before, you can only claim HST back if you’re registered for a GST/HST number with the CRA.

You’ll need to keep another spreadsheet outlining your monthly HST collections from outgoing invoices alongside HST claims from your expenses.

While claiming HST on your $10 rideshares might not do so much for you, it’s definitely awesome being able to claim it on bigger expenses like lawyer fees and laptops.

Oh, and make sure to hold onto receipts with the GST/HST details or you won’t be able to claim them.

6. You can’t expense everything

Unfortunately expensing things isn’t as simple as buying things for your business and the government paying you back for it, as David in Schitt’s Creek says.

Expensing business purchases just means that you’ll have a lower net income that you’ll have to pay taxes on later!

While there are many things you can expense under your business, there are also many restrictions.

You may be tempted to expense all your meals or coffee meetings, but that might trigger the CRA to come after you.

There’s a whole list of what you can and cannot claim as an expense along with different categories on the CRA website.

Remember that expensing things doesn’t make them free – it just means you’re reducing your taxable income!

Business expenses

Meals & entertainment

One thing to note is that you can only claim 50% of meals and entertainment, as it’s assumed that half of the bill is on behalf of your client.

You can’t claim your single coffee shop purchases, even if you’re buying that coffee to use the coffee shop as an office space to do your work.

To my knowledge, you can claim 100% of meal expenses if it’s a restaurant you’re visiting for review purposes (as a travel blogger or food writer), but don’t quote me on that.

I personally claim my full meal expenses if it’s for review purposes, and so do my fellow travel blogger friends!

Travel

You can claim rideshare fees as a business expense if you’re traveling to somewhere for work.

This includes things like a wedding for a photoshoot, a meeting with a client, or even a press event for bloggers.

You can also claim fees relating to your car, but you have to keep an actual record of the mileage used for work-related driving as well as receipts for gas and other vehicle expenses.

Unfortunately, you can’t claim the plane tickets you bought for vacation as a business expense, unless you legitimately are visiting for business.

If you’re a travel blogger visiting a destination specifically for work and not leisure, you’ll likely be able to claim your flights!

Home office

You cannot claim your entire internet bill or all of your rent, even if you work from home.

You can only claim how much of the space you’re using for work-related purposes, and you have to prove it.

In terms of claiming your internet bill, it depends on how much of it you’re using for work versus for binge-watching shows on Crave all weekend.

As for claiming your rent, it’s based on the square footage your home office takes up of your space.

I have a blog post all about work from home tips if you’re interested!

Capital cost allowance

Sadly, bigger expenses like new computers or cameras can’t be fully expensed at once.

Since they have value and contribute to your business over the course of time, you can only expense a percentage of the cost each year.

These bigger expenses are classified under capital cost allowance (CCA), which is the deductible amount you can claim over several years for the cost of depreciable property.

Each year you claim the CCA, it becomes a percentage of the remaining balance, and there’s a max amount you can claim each year.

7. Figure out whether you’re invoicing under your own name or your company

For the sake of making banking easier and organizing your finances, figure out who is invoicing your clients: you or your business.

If you’re a sole proprietor, you should be invoicing under your own personal legal name, unless you’ve registered your business name.

If you’ve incorporated your business, you should only be invoicing under your company name.

Your client will send cheques to whatever name you put down on your invoice.

You’ll have a tough time if you try to deposit a cheque to your personal bank account and it’s addressed to the name of your company you haven’t registered or incorporated.

Speaking from personal experience here!

8. In-kind partnerships count as income

If you’re exchanging an Instagram post on your feed for a $100 bottle of perfume, here’s something you should know: you legally have to claim that $100 as income.

Then, you have to pay Canadian income taxes on that $100. Fun stuff.

You might be thinking: But I didn’t receive any monetary compensation for it!

That doesn’t matter – it’s considered barter, and you’ve received something of value in exchange for your services.

So yeah, while you might be satisfied with receiving product in exchange for your work, don’t forget you’re pulling out money out of your own pocket to pay taxes on that “free” perfume.

What if a brand sends me a gift without asking for anything in exchange?

The exception around this is if you’ve received a product as a gift and the brand or PR company hasn’t asked for any guaranteed services in exchange.

In this case, it’s always better to write #gifted or #PRsample in any posts to make it clear that it was a gift and not something you received in exchange for work.

Will the CRA come after me for in-kind partnerships?

It may seem unlikely that the CRA will creep your Instagram feed and crack down on such small partnerships, but you obviously don’t want to take any chances.

More and more people in Ontario and beyond are becoming bloggers and social media influencers, which means more people potentially breaking the rules, and more potential audits.

Also, as I said in the very beginning, reporting all income is part of the law here in Canada, my friends.

Don’t try to be sneaky!

9. Freelancers have until June 15th to submit income tax returns

Most Canadian taxpayers have to submit annual income tax returns by April 30th of the following year.

For freelance workers, the deadline to pay taxes in Canada is actually extended to June 15th.

However, the CRA starts charging interest on taxes owed on April 30th, so it probably is a good idea to just follow the same deadline as everyone else.

Honestly, the earlier you get your taxes done, the better.

It ain’t fun scrambling to get it done at the last minute or pay interest.

10. The CRA recommends keeping business records for 6 years

You should keep any supporting documents that have to do with the info you’ve submitted to the CRA for a minimum of 6 years, including any invoices and receipts.

This is in case the CRA decides to review or audit your income tax returns or your small business.

The burden of proof is on you as a taxpayer, which means you’re responsible for keeping your records safe.

If you don’t have the relevant records the CRA needs and they audit you, they can fine you.

It’s all in the details, my friends.

How can I keep track of all my receipts?

Download any digital receipts and take photos of all of your receipts.

Store them in a folder somewhere safe.

There are also apps out there that can help you keep track of your receipts if this is something you’re worried about.

For your receipts, you should also mark down who you were with and what the purpose of your meeting was, because you likely won’t remember 6 years from now.

What do I do with my records after 6 years?

You can choose to hold onto your records or destroy them after 6 years are up.

It’s best to shred any important documents you wouldn’t want anyone to look at, or rip them up and dump them into different recycling bags.

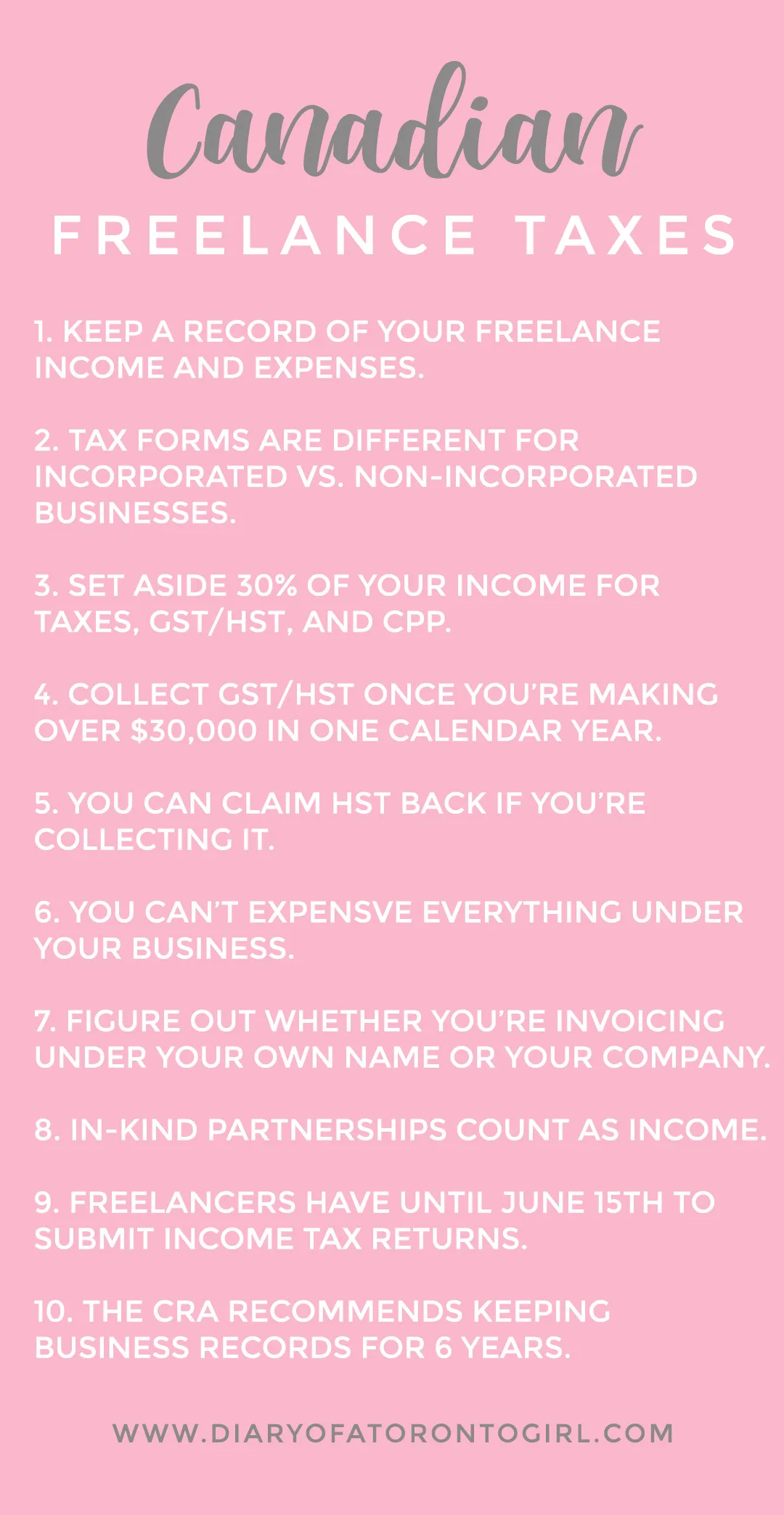

Things to know about freelance income taxes in Canada:

- Keep a record of your freelance income and expenses.

- Tax forms are different for non-incorporated vs. incorporated businesses.

- Set aside 30% of your income for taxes, GST/HST, and CPP.

- Collect GST/HST once you’re making over $30,000 in one calendar year.

- You can claim HST back if you’re collecting it.

- You can’t expense everything under your business.

- Figure out whether you’re invoicing under your own name or your company.

- In-kind partnerships count as income.

- Freelancers have until June 15th to submit income tax returns.

- The CRA recommends keeping business records for 6 years.

These are some of the important things I’ve learned about freelance taxes in Canada, and they’re accurate to the best of my knowledge.

Like I said, I’m not an accountant, and this is all information I’ve collected over my time as a self-employed person for the last 7 years.

For more information on freelance taxes in Canada, check out the CRA website or chat with an accountant.

Do you have any other tips on filing taxes as a freelancer in Canada? Let me know on Twitter or Instagram!

Be sure to keep up with me on Instagram, TikTok, Twitter, Facebook, and Pinterest if you aren’t already!

Feel free to subscribe to my weekly newsletter to get my blog posts delivered straight to your inbox.

Like this post? Pin it for later!

Frequently asked questions

You do not need to charge any taxes if you’re making under $30,000 as a freelance business in Canada.

Anybody can be a freelancer and you don’t have to register a business name or incorporate if you don’t wish to do so.

Create an invoice (a template can be used) with your information, your client’s information, and the fees and taxes (if applicable).

You do not need to have an incorporated business to invoice someone, and you simply just invoice under your own legal name.

Love the post! It was so helpful – I’ve been scouring the internet trying to find information on how freelancing finances work.

As an aside… do you have any resources on invoicing foreign clients?

Glad you found this post helpful, Suj! Invoicing foreign clients is the exact same, and if you charge HST/GST you just write “0%” and charge them your fee on its own.

Very informative post, thanks.

Glad you found it helpful Imran! 🙂

Very helpful. Thank you!

Happy to hear! 🙂

Very helpful article! Thank you!

A couple of questions that could make it even better and help me on the way 🙂

– You only need to submit the 2125 form once a year (before April 30)?

– In that 2125 you declare earnings and expenses from Jan 1 until Dec 30 of the previous year?

– When you declare expenses you add the GST/HST amount of each expense or you put the expense only with its market value amount?

– Do you need to submit any other form/declaration/etc.. to CRA throughout the year? (every month?)

– Do you need to create an account in CRA website in order to submit the form? Maybe you can share a little bit about that process.

– How do you actually pay the taxes (and when)? You transfer all that money from your bank account into a specific CRA account?

Thanks again!

Hi Sebastian, happy you found the article helpful! I’d recommend checking the CRA website or consulting an accountant for the most accurate information.

Thank you SO much for writing this post. Literal gold! So, so helpful! Thank you!!

Happy you found it helpful Kelly! 🙂

Hi, I’m wondering if you might have any advice regarding freelancing for US based companies, working from Canada. Are there any special rules for freelancing for US based companies?

Hi Kagan, you’ll have to do further research as I’m not exactly sure. In my experience, I think it’s been the same as freelancing for Canadian companies.

Great read for the first day of 2023. Cheers!

Glad you found this post helpful! Happy new year!

This was very helpful I was having trouble finding Canadian resources.

When you set aside taxes from each project you complete, how do you know how much to set aside? And do you put it in a separate account?

Should you put money aside for tax purposes each time you complete a project or just wait until you file your tax returns.

Thank you!!! 🙂

A general rule of thumb is to set aside 30% for taxes! I personally keep everything in one account, but some people find it helpful to put it in a separate one 🙂 Hope this helps!

Thank you for writing such an amazing post, extremely helpful!

Glad it was helpful! 🙂

Hi Jessica!

I’d be interested in getting a virtual address to keep conducting my freelance business in Vancouver while residing in another province.

Are you familiar with this concept? If so, do you know if I can communicate it to the CRA as a replacement for my current physical address?

Also, would I need to invoice the GST applicable in the province where the virtual address is, or in the new province?

Thank you in advance for your help and have a nice day/evening!

Hi Alicia, I’m not sure sorry, you’ll have to contact an accountant!

Hi Jessica, thanks for this post.

If I am freelancing and my client is international, should I include the payment processing fee and currency conversion fee in my invoice?

They have said that they will issue invoices and they do not need me to issue them invoices.

Is it ok if I prepare an invoice myself for tax purposes without their name? So just my name, services provided/projects, and fees? Does it make a difference if I prepare a monthly invoice or an invoice at the end of the year that encompasses all the projects completed?

Thanks,

Brooke

Hi Brooke, I would definitely contact an accountant, as it’s typically the freelancer issuing the invoices!